4 Simple Techniques For Succentrix Business Advisors

Table of ContentsGetting The Succentrix Business Advisors To WorkHow Succentrix Business Advisors can Save You Time, Stress, and Money.8 Easy Facts About Succentrix Business Advisors ShownLittle Known Questions About Succentrix Business Advisors.The Single Strategy To Use For Succentrix Business Advisors

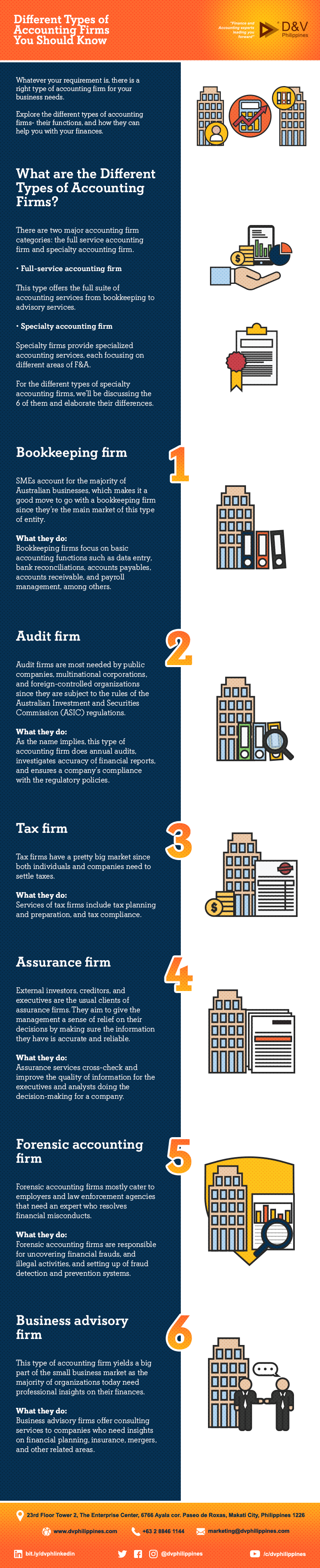

Getty Images/ sturti Outsourcing audit solutions can release up your time, avoid mistakes and even minimize your tax costs. Or, maybe you want to manage your basic bookkeeping tasks, like accounts receivables, but employ a consultant for money flow projecting.Discover the various kinds of accounting solutions available and find out exactly how to pick the right one for your small company requirements. General bookkeeping refers to routine duties, such as videotaping purchases, whereas economic accounting strategies for future development.

Prepare and file tax obligation returns, make quarterly tax obligation repayments, documents expansions and handle Internal revenue service audits. Produce monetary declarations, consisting of the equilibrium sheet, revenue and loss (P&L), cash flow, and earnings declarations.

Unknown Facts About Succentrix Business Advisors

Track job hours, calculate wages, hold back taxes, concern checks to workers and guarantee precision. Audit solutions might also consist of making payroll tax obligation repayments. Furthermore, you can hire specialists to design and establish your bookkeeping system, provide monetary preparation recommendations and explain economic statements. You can contract out chief economic police officer (CFO) solutions, such as sequence preparation and oversight of mergers and purchases.

Typically, small company proprietors outsource tax obligation services initially and include pay-roll aid as their firm expands. According to the National Small Company Organization (NSBA) Local Business Taxation Survey, 68% of respondents utilize an exterior tax specialist or accounting professional to prepare their company's taxes. On the other hand, the NSBA's Innovation and Service Survey discovered that 55% of local business proprietors manage payroll online, and 88% manage banking accounts electronically.

Develop a checklist of processes and tasks, and highlight those that you want to outsource. Next, it's time to find the best audit service provider (cpa near me). Currently that you have an idea of what kind of accounting services you require, the concern is, who should you employ to give them? As an example, while a bookkeeper handles data entrance, a CPA can talk in your place to the internal revenue service and give economic suggestions.

The Best Strategy To Use For Succentrix Business Advisors

Prior to deciding, take into consideration these inquiries: Do you desire a regional accountancy expert, or are you comfy functioning virtually? Should your outsourced solutions incorporate with existing accountancy tools? Do you need a mobile app or online site to manage your audit services?

Use for a Pure Leaf Tea Break Grant The Pure Fallen Leave Tea Break Grants Program for little businesses and 501( c)( 3) nonprofits is currently open! Concepts can be new or already underway, can come from HR, C-level, or the frontline- as long as they enhance worker health via culture modification.

Something went incorrect. Wait a minute and try again Try once again.

Advisors have a peek here provide useful understandings into tax strategies, ensuring services reduce tax obligation obligations while abiding by complex tax guidelines. Tax obligation preparation includes positive measures to optimize a company's tax setting, such as deductions, credit scores, and motivations. Keeping up with ever-evolving bookkeeping requirements and regulative requirements is important for organizations. Audit Advisory professionals assist in monetary coverage, ensuring accurate and compliant monetary declarations.

Not known Factual Statements About Succentrix Business Advisors

Here's a comprehensive consider these vital abilities: Analytical abilities is an essential skill of Bookkeeping Advisory Providers. You ought to excel in event and assessing monetary information, drawing significant understandings, and making data-driven suggestions. These abilities will allow you to examine monetary efficiency, recognize fads, and offer notified advice to your customers.

Connecting successfully to customers is an essential ability every accountant must possess. You need to have the ability to communicate complex monetary details and insights to customers and stakeholders in a clear, easy to understand way. This includes the ability to convert economic lingo right into simple language, create comprehensive reports, and supply impactful discussions.

3 Easy Facts About Succentrix Business Advisors Described

Accounting Advisory firms make use of modeling techniques to simulate different financial situations, assess prospective outcomes, and support decision-making. Effectiveness in financial modeling is important for exact forecasting and calculated preparation. As an audit consultatory company you should be well-versed in economic guidelines, bookkeeping standards, and tax obligation regulations appropriate to your clients' industries.